Westpac turns to iMessage after social media keyboard flop

Westpac Banking Corporation has announced an iMessage shortcut for customers using iOS devices, giving Apple-made devices another shot after its keyboard function was removed a few months after launch last year.

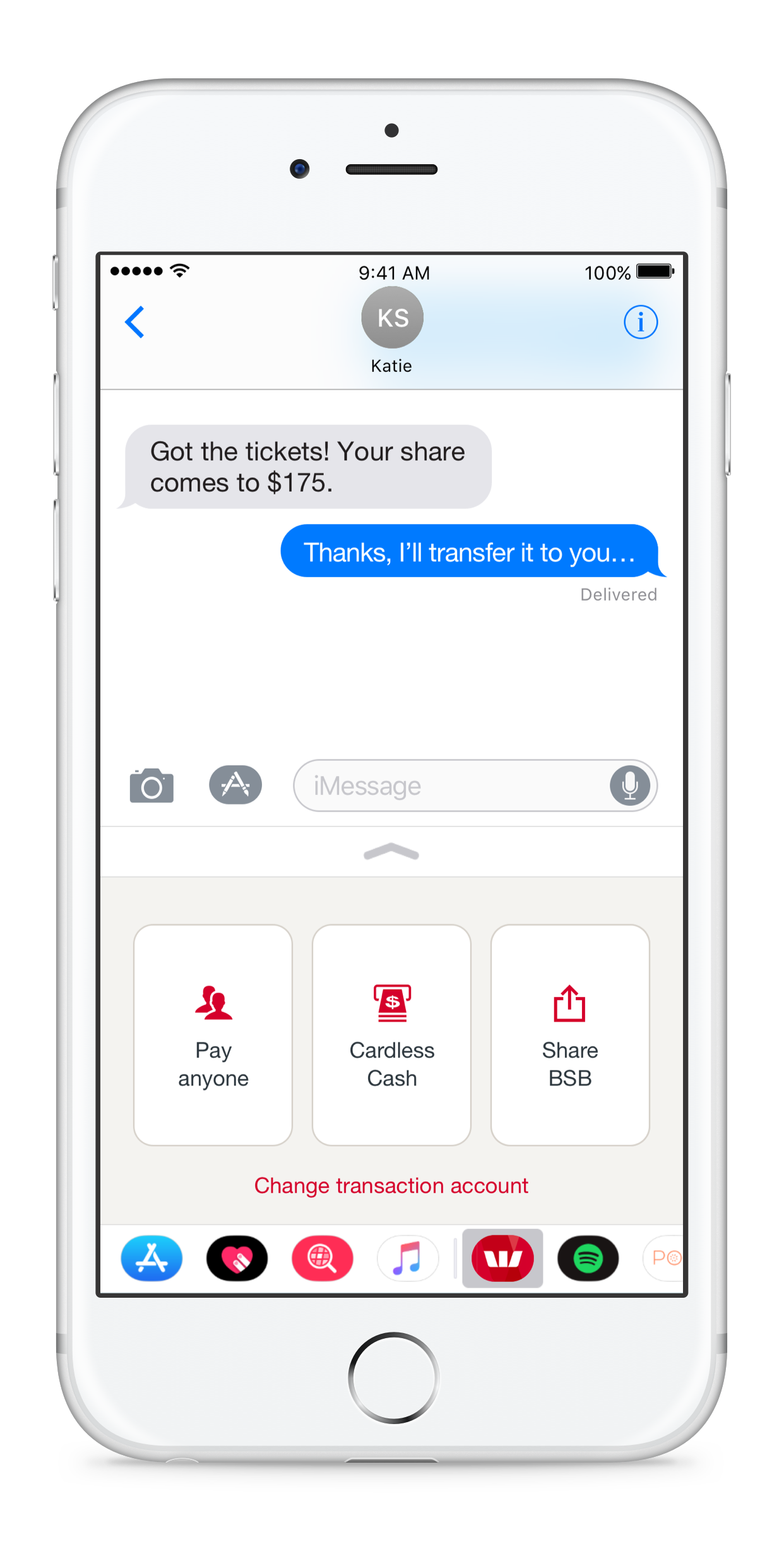

While texting a contact on their iPhone, customers can click on the Westpac icon visible within their text conversation window and make payments, generate a "cardless cash code", and share their BSB and account details from within the one window.

To make a payment via Westpac for iMessage, customers can tap the Westpac icon, sign in with their password, select a payee from their contacts list, enter a dollar amount and description, confirm the payment, and then send a text message to the payee detailing the transfer.

Customers with iMessage enabled on their iPhone with iOS11 and the latest version of the Westpac app -- v8.4 -- will be able to use the capability.

An extension of the Westpac Mobile Banking app, the new offering is the bank's second attempt at an Apple plug-in after losing the fight with a handful of competing banks to collectively bargain with the iPhone maker for open-access to the NFC functionality on the iPhone.

The bank launched the social media-based Westpac Keyboard in March last year, touted by Westpac chief executive of Consumer Bank George Frazis at the time as the "ultimate" mobile banking experience for those who love social media and messaging apps.

The keyboard, available for use via social media messaging apps such as Facebook Messenger, WhatsApp, Twitter, Snapchat, and WeChat, as well as SMS, was shortly removed from iOS devices in July at the request of Apple.

Westpac on Thursday announced the integration with Amazon Alexa, launching a Westpac skill for the voice-activated assistant ahead of its Australian availability next month.

With Alexa, Westpac customers who have enabled the skill and linked to their Westpac account can ask a range of questions relating to their account balance and their last 50 transactions.

Speaking with ZDNet, Westpac GM of consumer digital Travis Tyler said integrations like the Alexa one is all about allowing the customer to interact with the bank when, where, and how they want.

"If we go back 10 years, the last big shakeup in financial services was effectively when mobile banking came to light; it was all about what you could do on your time at a place you wanted to," he explained.

"What we're going to see with this next wave is the rise of the new ecosystem and what we're going to have is a banking experience that fits into your life in your way, and it's going to be very personal and you'll tailor it to how it suits you in that moment and it will be all about the interaction.

"We've gone from banking being a destination to then banking being an activity that you do on your terms."

The Alexa skill was born out of the recently launched Westpac Digital Labs, which is a small group of staff comprised of designers and engineers that get to play with innovation within the bank.

The team was also responsible for Westpac's iPhone facial biometric offering, and its wearable payment platforms, with a handful of staff also behind the fingerprint authentication service from a few years ago.

"They've got a proven track record and we've now formalised that and the good thing is we're actually generating a lot of interest for people to join that team as well. We want to keep it small and nimble, and that helps drive that innovation culture," Tyler said.

"There are elements that still need to have that right risk lens around it, because at the end of the day, we're a highly regulated and really important part of the economy, so we innovate where we can and where we should, and then we still put the right level of governance around the things that should have it."

For the 2017 financial year, the bank reported AU$7.99 billion in after-tax profit, on revenue of AU$21.8 billion, an increase of 4 percent year-on-year.

As of September 30, 2017, Westpac boasted 13.8 million customers; 4.53 million were considered digitally active, with 72 percent of them using a mobile platform.

PREVIOUS AND RELATED COVERAGE

Westpac adopted 'workforce revolution' to combat technology-based job losses

Although Westpac has laid-off about 1,000 staff over the past 24 months, its CEO has called the hype of technology replacing jobs 'overdone'.

NAB sees Amazon Alexa integration as pointing to the future of banking

NAB said the use of voice assistants and other third-party banking channels is a 'natural evolution' of the use of digital channels.

Australia to finally get its hands on Amazon Alexa

Years after the assistant took up residency in homes overseas, Amazon has finally introduced Alexa and its Echo, Echo Plus, and Echo Dot offerings in Australia.

Amazon Alexa: The smart person's guide (TechRepublic)

Amazon Alexa is the leading digital assistant on the market. Find out more about this machine-learning innovation with our Alexa smart person's guide.

16 technical Alexa skills IT pros should know (TechRepublic)

Alexa offers an array of functions to serve as a helpful technical guide. The skills in this list can help you with things like network diagnostics, IP address lookups, and programming questions.